CREDIT.ORG

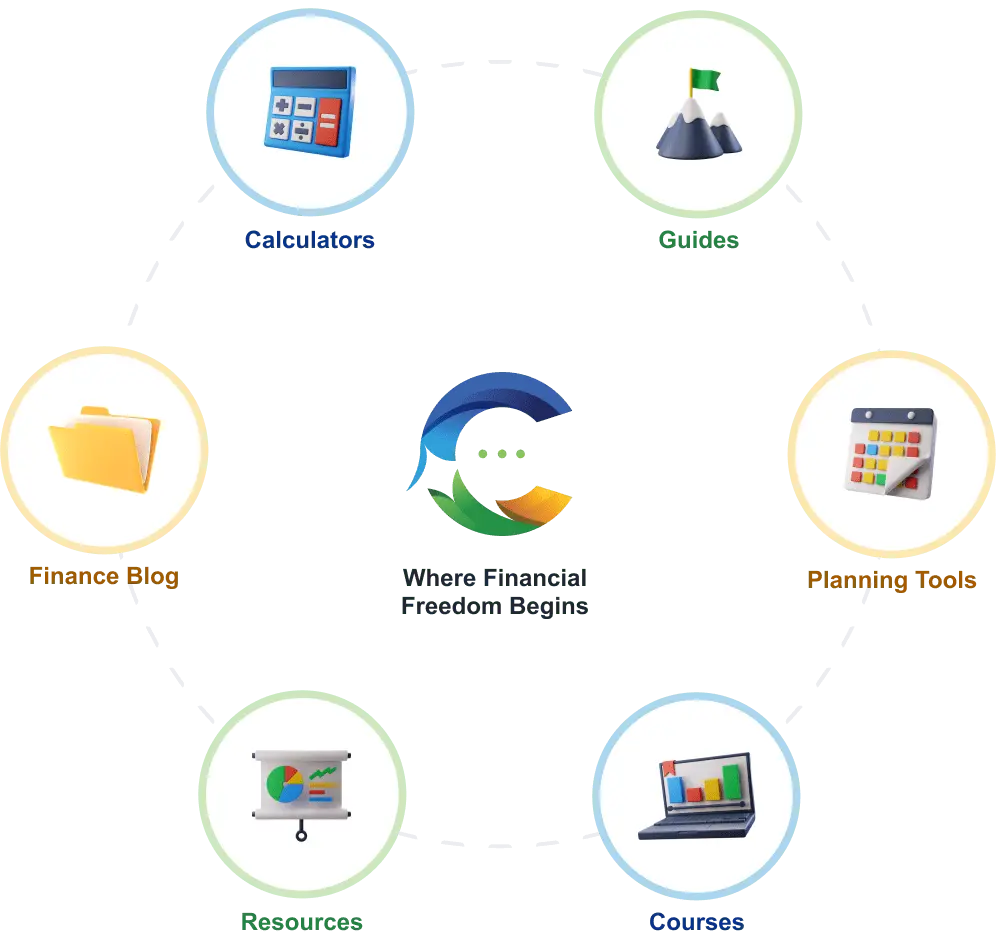

Unlock Financial Freedom With Our Nonprofit Credit Counseling Agency

Looking to build or improve your credit?

Credit.org’s certified credit counselors specialize in consumer credit counseling, offering you insights, strategies, and guidance tailored to your unique financial situation. Embark on a journey towards improved credit health and financial freedom with a reputable credit counseling organization.

Credit.org’s certified credit counselors specialize in consumer credit counseling, offering you insights, strategies, and guidance tailored to your unique financial situation. Embark on a journey towards improved credit health and financial freedom with a reputable credit counseling organization.

-min.webp)

-min.webp)