Established in 1974, Credit.org is a national nonprofit financial wellness organization, recognized as one of the earliest U.S. Department of Housing and Urban Development (HUD) approved nonprofit and consumer credit counseling services (CCCS) agencies nationwide. Our HUD-approved housing counseling programs have consistently improved housing outcomes for first-time homebuyers, homeowners, renters, and those overcoming homelessness.

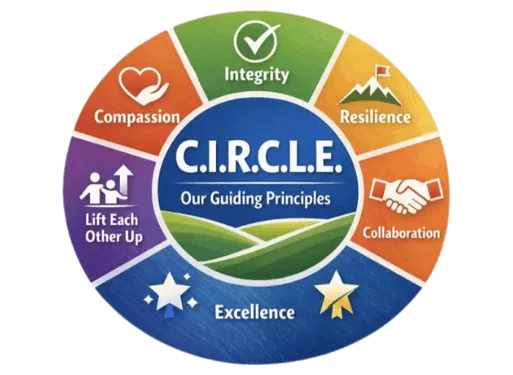

Click to reveal details about our core values.

We empower individuals and communities to achieve a brighter financial future through trusted counseling and education, turning goals into action.

To bridge the financial health gap by expanding access to education, counseling, and partnerships that guide individuals and families toward stability to build strong, thriving communities.

C

We meet people where they are with empathy and respect, knowing that money challenges and goals are personal.

I

We do the right thing - honest, transparent, and accountable in every interaction and decision.

R

We face change and challenge with focus, quick adaptation, to keep moving forward to deliver results.

C

We work as one team across roles and partners, sharing knowledge and aligning to expand our impact.

L

We lead with encouragement - supporting,coaching, and celebrating each other so everyone can do their best work.

E

We hold a high bar for quality and reliability, delivering consistent, accurate, trusted services that make a lasting difference.