⚠ Important Notice: We provide services only to clients residing in the United States ⚠

When facing financial hardship, you may be offered a break from your mortgage payments. This break can come in the form of deferment or forbearance. Both options let you temporarily stop or reduce payments, but they work differently and carry unique pros and cons. Understanding the difference is key to protecting your home and your long-term financial health.

This guide explains how each option works, what situations qualify, and how to decide which is right for your needs. We’ll also cover important terms like payment pause, interest accrual, and repayment options so you can make a smart and informed choice.

Your monthly loan payments usually cover more than just the loan principal. Each payment often includes interest, property taxes, and insurance. Missing a few payments can lead to serious consequences, like late fees or foreclosure. If you’re struggling, the worst thing to do is ignore the problem. Talk to your loan servicer immediately to explore your options.

Even a short break from your loan payments, if done the right way, can keep your credit intact and help you avoid long-term damage. But not all relief options work the same way. That’s where deferment and forbearance come in.

Loan forbearance allows you to temporarily reduce or stop making payments. This option is usually granted by your lender when you’re facing a short-term hardship like job loss, medical bills, or natural disaster recovery. Unlike deferment, forbearance doesn’t usually stop interest from building up during the pause. That means your loan balance can grow.

Most forbearance plans are short-term; usually three to six months. However, extensions are possible depending on your lender’s policies and your financial situation. Always get the terms in writing and confirm how interest accrues during the forbearance period.

Mortgage forbearance became a household term during the COVID-19 pandemic, when millions of homeowners were granted a temporary pause on their payments. While those programs were federally mandated, today’s forbearance programs are typically offered at the lender’s discretion.

To qualify, you’ll often need to explain your financial situation and show proof of hardship. Reasons may include:

Some lenders offer general forbearance, while others only approve mandatory forbearance for specific events. Make sure to ask if interest will accrue during your paused payments and what the repayment plan will look like afterward.

Loan deferment also allows you to temporarily delay payments, but it works a little differently. In many deferment plans, interest does not accrue during the pause; especially if the plan is related to a federally backed loan or disaster relief. However, this is not guaranteed, especially with private mortgage lenders.

Deferment is often granted after a hardship ends. For example, a homeowner who experiences a layoff may complete a trial repayment period and then receive a deferment for the remaining missed payments. The paused payments may be moved to the end of the loan term.

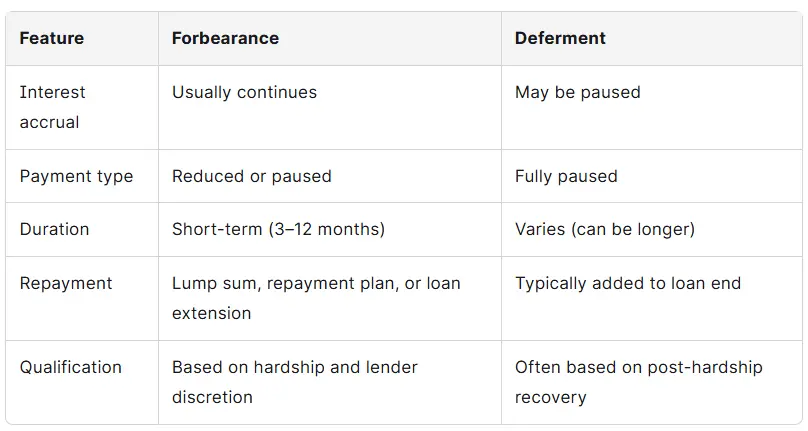

Though both options offer temporary payment relief, deferment and forbearance differ in a few critical ways:

Choosing the right option depends on your lender’s rules, your financial hardship, and your repayment goals.

You might qualify for a payment pause if you’re experiencing financial hardship due to events such as:

Your loan servicer will evaluate your financial situation to determine whether you qualify for deferment or forbearance, or if a different repayment plan would work better. To avoid falling behind, be proactive about contacting them early.

Learn more about housing counseling services offered by Credit.org, which can help guide you through this process.

Both deferment and forbearance are temporary. Once the period ends, you’ll need to resume your regular monthly payments, and possibly repay the paused amounts. The repayment structure can vary depending on your lender and the type of assistance you received.

In a forbearance plan, repayment options may include:

With deferment, missed payments are more often added to the end of the loan term, extending your repayment period. However, this depends on your lender’s policies and whether you qualify for a full deferment versus a temporary forbearance.

When hardship strikes, your first step should be to contact your loan servicer. This is the company that handles your loan payments, not necessarily the lender that originated the loan. Ask about:

Lenders typically require proof of financial hardship, such as layoff notices, medical bills, or disaster declarations. Some situations may qualify you for a mandatory forbearance, while others rely on the discretion of your servicer.

See Credit.org’s advice on writing a hardship letter to your lender.

Once your payment pause ends, repayment options may include:

If you’re unsure what’s available, ask your servicer to explain all repayment plans in writing. Make sure you understand how interest accrued during the pause and whether it was capitalized into your balance.

Not all hardships require the same solution. You might prefer:

If you’re unsure, consult a nonprofit housing counselor or financial coach. They can help assess your situation and explain the long-term impacts of each option.

Most articles on this topic focus on student loans, but mortgage loans follow a different set of rules. Many servicers offer mortgage forbearance after qualifying hardships like:

Mortgage deferment is less common but may be available through government programs or specific lenders. Always clarify which program you’re being offered.

This HUD.gov guide to avoiding foreclosure provides trustworthy, up-to-date information on mortgage relief programs.

If managed properly, deferment and forbearance should not hurt your credit. Most lenders will not report paused payments as delinquent if the relief was approved ahead of time. However, interest may continue to accrue, increasing your loan balance.

Late or missed payments outside of an official pause can damage your credit score. Always confirm that your payment pause has been approved and documented before you stop making payments.

If you’re unsure whether your servicer reported forbearance or deferment to the credit bureaus, check your credit report. You can get a free copy at AnnualCreditReport.com once per week.

Here are some common mistakes to watch out for:

Whether you’re dealing with loan deferment, mortgage forbearance, or a payment pause, the stress can be overwhelming. Help is available.

Credit.org’s housing counselors offer one-on-one support for homeowners facing hardship. They can walk you through the application process, explain your options, and help you build a plan for long-term success.

You can also explore trusted government programs through sites like ConsumerFinance.gov or DisasterAssistance.gov.

Although this article focuses on mortgage loans, it’s helpful to understand how deferment and forbearance apply to student loans, as many borrowers manage both types of debt at once.

Student loan deferment allows borrowers to pause payments on qualifying federal student loans, often without interest accruing. This is especially true for subsidized loans, where the government may cover the interest during the deferment period. Common deferment situations include active enrollment in school, military service, or participation in an approved rehabilitation training program.

Student loan forbearance, on the other hand, typically allows borrowers to pause or reduce payments for up to 12 months, but interest continues to accrue on all types of federal and private student loans. Forbearance is often granted during financial hardship, illness, or other temporary disruptions.

Both options are available through federal loan servicers and require an application process. Borrowers should weigh the costs carefully, especially when interest continues to grow. It’s also important to avoid defaulting on your student loan payments while waiting for approval.

If you’re managing a mortgage loan and student loans at the same time, speak with your loan servicer and explore repayment options that coordinate across both debts. Deferment or forbearance may be used for one or both loans depending on your situation.

Student Loan Help is available from Credit.org.

When used wisely, forbearance and deferment can help you protect your home and your finances. But they come with rules and consequences; especially when interest continues to accrue. Always talk to your loan servicer early, understand the repayment terms, and get help if you need it.

Schedule your free housing counseling appointment or call 800-431-8157 to speak with our certified housing counselors today.