Exploring the different types of home mortgage loans available will present you with a wide array of products, terms, and options. There are important differences to understand and consider in each of these areas, and it can get complex and complicated. It’s a good idea therefore to start with the basics. If you are interested in some home loan tips, check out our homeownership page.

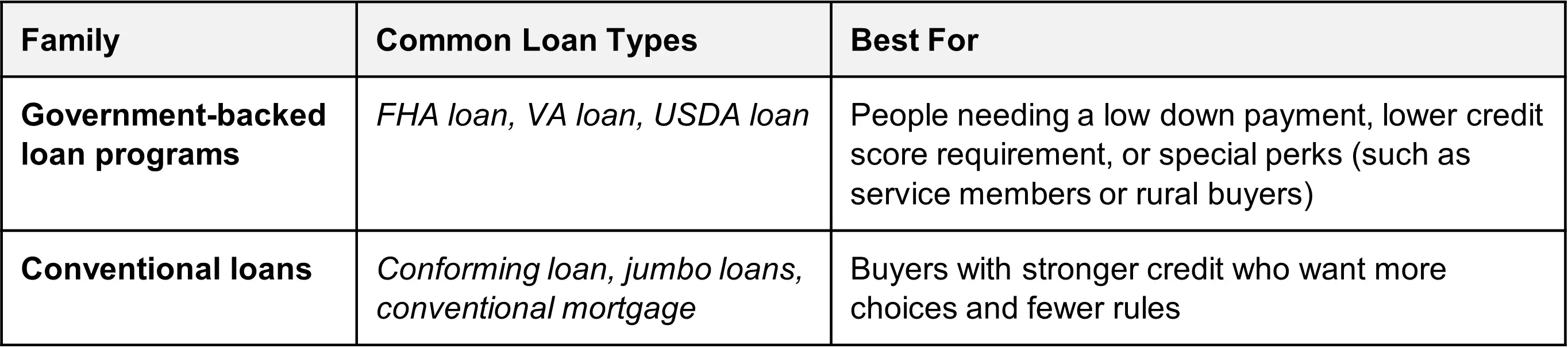

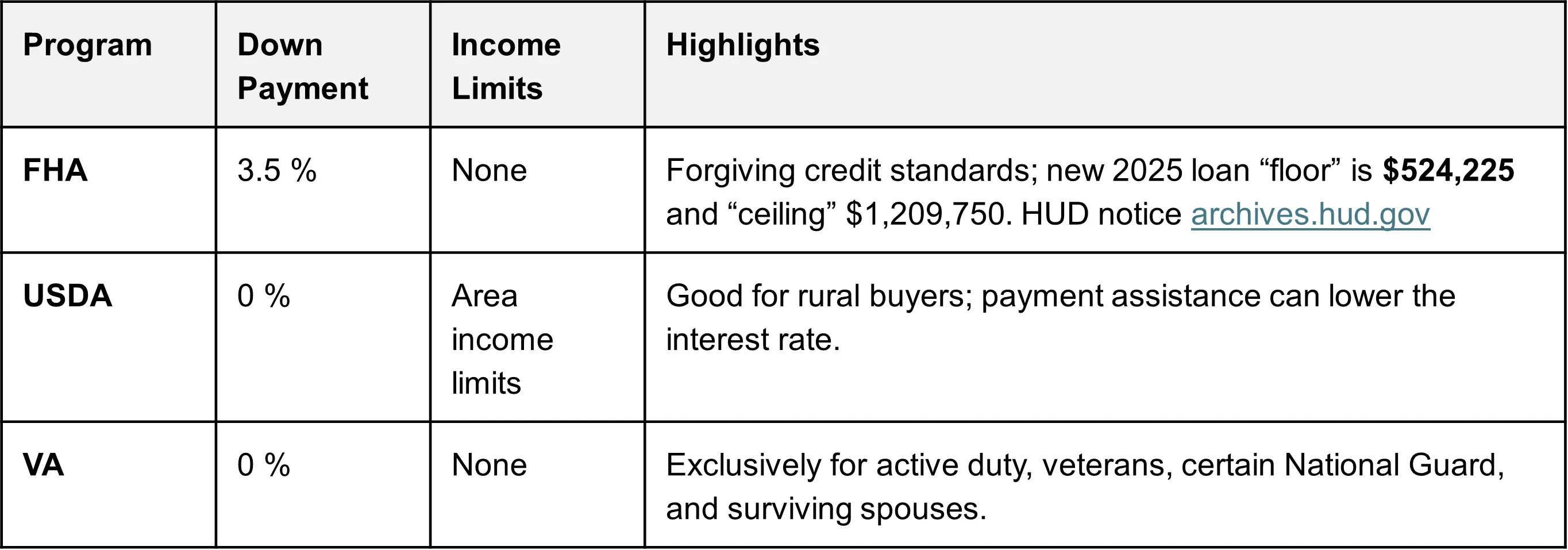

Most borrowers pick from two big families of mortgage loans:

Because each choice has different payment requirements, interest rate rules, and closing costs, shop around and compare at least three lenders before you decide.

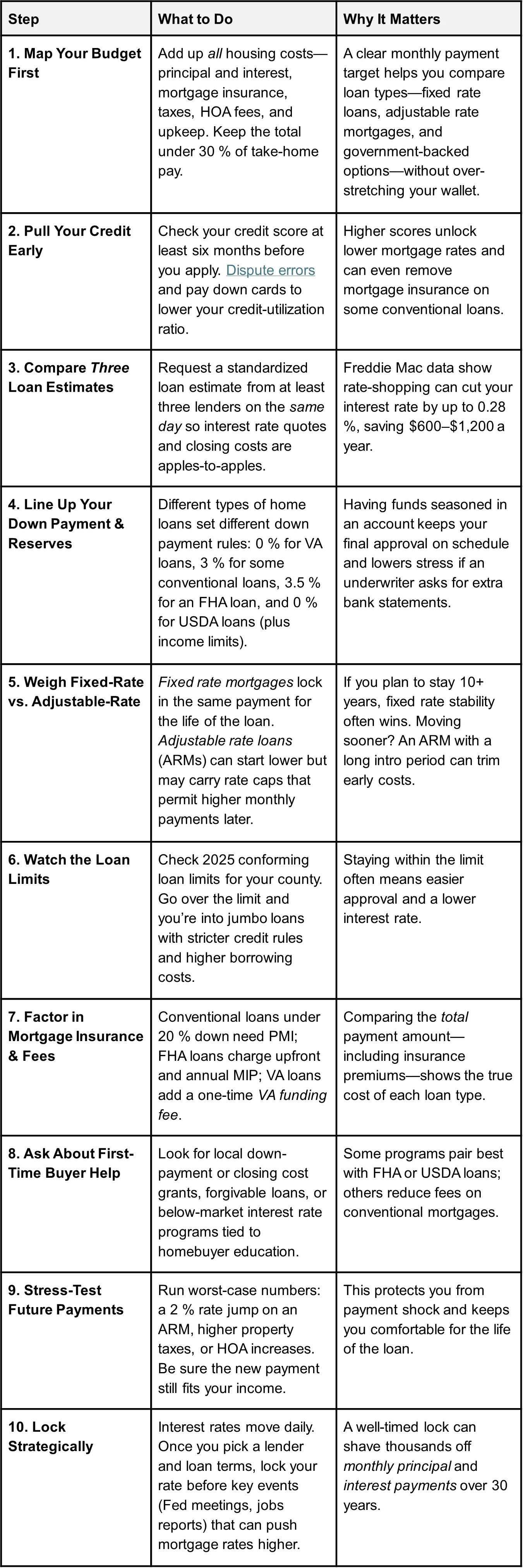

Your monthly payments include:

Calculate the full payment amount, not just the loan, so higher borrowing costs do not surprise you later.

A fixed rate mortgage keeps the same interest rate for the life of the loan. That means predictable mortgage payments and less risk if rates climb later. Fixed rate loans work well for most first time homebuyers who need steady monthly principal they can budget for.

Adjustable rate mortgages start with a low introductory interest rate, then change on a set schedule. Look for:

ARMs can lower payment amount early on, but may lead to higher monthly payments after a few years.

-min.webp)

A mortgage lender can be a bank, credit union, or private lender. Ask for a loan estimate to compare fees, rate, and loan terms. Federal agencies like the Federal Housing Administration (FHA), Federal Housing Finance Agency (FHFA), Fannie Mae, and Freddie Mac set many of the rules lenders follow.

Loans above local conforming loan limits are called jumbo loans and usually carry higher interest rates. The FHFA raised the 2025 one-unit baseline limit to $806,500. In high-cost areas it can top $1.2 million. See the full table in the FHFA’s 2025 release. Check the limit in your county. fhfa.gov

Backed by the Department of Veterans Affairs, a VA loan offers:

The 2025 update changed the VA funding fee schedule, double-check the latest table before you lock your loan. See the January 2025 circular. benefits.va.gov

The loan estimate shows:

Compare at least three estimates to find less risk and better terms.

Rates change daily. As of May 29 2025, the average 30-year fixed rate sat at 6.89 %, while the 15-year fixed was 6.03 %. Freddie Mac’s survey urges buyers to “shop around” because even a 0.25 % difference can save thousands over the loan term. freddiemac.com

Pro Tip: Use a trusted, free mortgage calculator to plug in principal and interest, PMI, taxes, and insurance for each loan scenario. Seeing the numbers side by side makes the best loan type stand out quickly.

Whether you pick a fixed rate mortgage, an ARM, a jumbo loan, or one of many other loan types, the right choice hinges on your budget, credit profile, and long-term plans. Use this guide, review at least three loan estimates, and lean on trusted professionals to make the smartest move for your future home.

Need more help? Credit.org offers free, nonprofit counseling for first time homebuyers and anyone comparing different types of home loans. Reach out today to clarify your next steps.