Your credit score is one of the most important numbers in your financial life. It affects whether you can rent an apartment, buy a car, get a credit card, or qualify for a mortgage. Understanding credit score levels helps you know where you stand and what you can do to improve your credit.

Credit score levels are categories that tell lenders how risky or trustworthy you may be as a borrower. Most credit scores fall between 300 and 850, with higher numbers representing stronger creditworthiness.

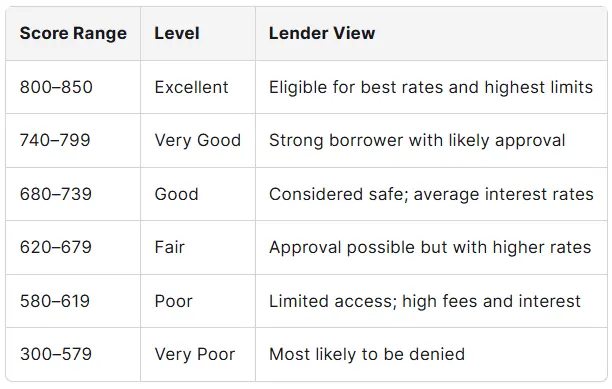

Here’s a basic breakdown of credit score levels, according to Credit.org:

These categories help lenders make decisions. If you’re in the good or excellent range, you’re more likely to get approved for loans and credit cards. You’ll also qualify for lower interest rates, which saves money over time.

Not all lenders use the same standards when evaluating your score. While one lender may approve someone with a 680 score, another may require 700 or higher. Your interest rate, loan terms, and credit limit can all vary depending on your credit score range.

The most common models, like FICO and VantageScore, now both use the 300–850 scale. But the way they calculate your score can differ, which is why you might see different credit scores when checking across platforms or reports.

It’s important to understand the difference between your credit score and your credit report. A credit report is a detailed record of your financial activity. It lists your credit accounts, balances, payment history, and more. A credit score, on the other hand, is a three-digit number based on that data.

You can get a free copy of your credit report from all three major credit bureaus—Equifax, Experian, and TransUnion—by visiting AnnualCreditReport.com, which is the only site authorized by federal law.

Regularly reviewing your credit report is one of the best ways to catch errors, monitor identity theft, and stay on top of your financial health. If your report contains mistakes, your credit score could suffer.

Each of the three bureaus collects data independently. That’s why your score might not be the same across all of them. One lender might report activity only to Experian, while another sends updates to all three. This variation is one reason for different credit scores across your reports.

Some lenders use the average of all three scores, while others rely on just one bureau. It’s also common to see lenders pull your score from different bureaus depending on the type of loan. For example, a car loan might use your Equifax score, while a mortgage lender might check all three.

Credit scores are calculated using different factors. While each credit scoring model (FICO or VantageScore) weighs these factors differently, they all consider the same five basic areas:

One of the most important factors is credit utilization. This is the ratio of your credit card balances to your total credit limits. For example, if your total available credit is $10,000 and you’re using $3,000, your utilization rate is 30%.

Experts recommend keeping your credit utilization below 30%, and ideally under 10%. High utilization can hurt your score even if you pay your bills on time. Paying down your balances is a quick way to improve your credit standing.

-min.webp)

There are several reasons you might see different credit scores when you check your reports or apply for credit:

Because of this, it’s a good idea to check all three reports at least once a year. You can also use tools like Experian Boost, which lets you add utility and phone bill payments to your credit history to improve your score.

A good credit score typically starts at 680. But depending on the lender, you may need to hit 700 or even 740 to qualify for the best interest rates.

According to FICO, scores are generally grouped like this:

If your score is below 620, you might have trouble qualifying for credit or may face higher interest rates. If your score is above 740, you’re in great shape and should expect lower interest rates and more favorable loan terms.

Your credit history is a record of how you’ve used credit over time. The longer your accounts have been open, the better. It shows lenders that you’re a stable, reliable borrower.

If you’re just getting started, consider:

These tools can help you start building your credit even if you have no previous history. For more advice, see Credit.org's guide on how to build your credit from nothing.

Your credit mix refers to the different types of credit accounts you have. Lenders want to see that you can manage multiple forms of credit responsibly. This might include:

Having a variety of accounts in good standing can help your score, especially if you’re building credit for the first time. However, you don’t need every type of credit. It’s better to only open accounts you need and can manage responsibly.

Improving your credit score takes time, especially if you’ve had past issues like missed payments or high balances. Small changes can help over time:

The amount of time it takes to raise your score depends on your current standing and the severity of past credit issues. In general, most people can see noticeable improvements within 6 to 12 months by following healthy credit habits.

One of the most frustrating things about credit is how scores can differ depending on where you look. As mentioned earlier, different credit scores can result from different scoring models, data variations, and timing.

Even if two lenders pull your score from the same bureau, they might use different formulas tailored to the kind of credit you’re applying for. For example, a credit card issuer might emphasize payment history and credit utilization, while a mortgage lender could weigh your full credit history more heavily.

That’s why there are multiple credit score ranges that may look similar but serve different purposes. It’s not uncommon to see VantageScore place you in a different tier than FICO, even though they both use the 300–850 scale.

When your credit is checked, it’s either a soft or hard inquiry.

Too many hard inquiries in a short period can be a red flag for lenders. If you’re rate shopping (like for a mortgage), try to apply within a short window; FICO typically treats multiple inquiries within 45 days as one.

Checking your credit report regularly is essential. It’s the only way to know exactly what information is being used to calculate your score. Look for:

If you find an error, you have the right to dispute it. The Consumer Financial Protection Bureau (CFPB) offers guidance on how to file a dispute with each credit bureau. Correcting an error could improve your score quickly if the mistake was holding it down.

Another good resource for credit report disputes is our free Consumer Guide to Good Credit.

Credit scores are not updated in real time, but they can change as often as your credit reports are updated. This usually happens every 30 to 45 days, depending on the creditor. If you pay off a credit card or make a large payment, you might see an improvement in your score the next time that account reports to the bureaus.

If you’re actively working on improving your credit, keep in mind that changes may take a month or more to show up in your scores. You can track your progress using tools from your bank, credit union, or nonprofit credit counseling agency.

Several tools are available to help monitor and improve your score. These include:

Credit.org offers free, confidential credit counseling services for individuals who want to improve their scores and manage their finances better.

If you don’t have any credit history, you won’t have a credit score. That’s known as being “credit invisible.” About 26 million Americans fall into this category, according to a recent report from the CFPB.

You can begin building your credit by:

With consistent, on-time payments, you can begin to build a positive credit history and move through the credit score levels over time.

Understanding how lenders interpret your score can help you plan your financial goals. Here’s a simplified chart of how credit score levels may be viewed:

Each lender may set its own rules, but staying in the good or better range gives you access to better opportunities and more financial flexibility.

If you want to raise your credit score to the next level, here are simple steps to follow:

By doing these things consistently, you can move up through the credit score levels and put yourself in a better position to achieve your financial goals.

If you’re unsure where to start, you’re not alone. Many people feel overwhelmed by the numbers and rules behind credit. That’s why resources like Credit.org exist. Whether you need help improving your credit, reducing debt, or creating a financial plan, we’re here to help.

Start with a free credit report review to better understand your current situation. Our certified counselors can explain what’s on your report, how it affects your score, and what steps you can take next.