Paying off debt is a major step toward long-term financial stability. If you’re juggling credit card debt, personal loans, or other accounts, it can be hard to decide where to begin. Should you pay off your smallest debt first, or tackle the account with the highest interest rate? Should you consider a loan to combine your balances?

This article will walk you through the two most common debt repayment strategies: the debt snowball method and the debt avalanche method. We’ll compare how they work, do the math on both approaches, and explain why Credit.org does not recommend relying on a debt consolidation loan as your first solution. We’ll also cover a few other options you may want to consider.

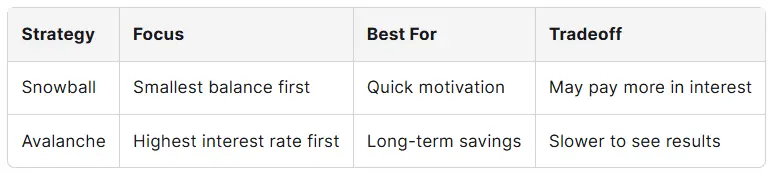

Two debt repayment strategies stand out for their simplicity and effectiveness: the snowball and the avalanche. Both the avalanche and snowball methods encourage you to focus on one debt at a time while keeping up with minimum payments on the rest. That keeps things manageable and helps you build momentum.

The debt snowball method focuses on paying off the smallest balance first, while the avalanche method targets the highest interest rate. Each has its benefits, depending on your personality and goals.

The debt snowball method is a great option for anyone who wants to feel quick progress. You start by listing your debts from the smallest balance to the largest. Then, you pay as much as possible toward the smallest debt, while making minimum payments on the others.

Once that initial debt is gone, you roll the amount you were paying into the next smallest debt. Your payments grow like a snowball, making it easier to clear each subsequent debt faster than the last.

The snowball strategy works well for people who need motivation. Seeing a small credit card balance drop to zero can give you a strong emotional boost. It builds confidence and creates a sense of progress that keeps you going.

This method doesn’t focus on interest rates, so it might cost you a bit more in the long run. But it works, especially for people who feel overwhelmed by multiple debts and need to take control.

The debt avalanche method is all about math. Instead of focusing on the smallest balance, you start by paying down debt with the highest interest rate. As with the debt snowball method, you continue making minimum payments on all your debts, but any extra money goes toward the costliest debt first.

When that high-interest account is gone, you move to the next highest rate. This strategy saves the most money over time and can shorten the total repayment period.

Because this method prioritizes interest savings, it’s a smart choice if you want to reduce the total amount you pay. But it can be harder to stick with. If your highest-rate debt also has a high balance, it might take longer to pay off, meaning less visible progress at the start.

That’s why some people struggle to stay motivated using the avalanche method, even though it’s technically more efficient.

Let’s compare the snowball and avalanche side by side:

Some people switch methods partway through. They might start with the debt snowball method to gain traction, then shift to the avalanche once they’ve eliminated a few accounts. The key is to stay consistent with whichever method keeps you going.

Let’s say you have three credit cards:

You’ve budgeted $500 per month to repay your debt. Your minimum payments are $30 (Card A), $60 (Card B), and $150 (Card C). That totals $240.

Using the snowball method, you start with the smallest balance: Card A.

This is how the snowball method builds. As each debt is paid, your monthly payment toward the next one increases.

With the debt avalanche method, you target the highest interest rate first. That’s Card C in this case.

Then you apply the full $500 to Card B, then Card A.

Over the full repayment period, this method results in less total interest. But it takes longer to eliminate your first debt, which can feel like slow progress.

.webp)

if you talk to personal finance experts or a financial advisor, you'll likely get a recommendation to use the debt avalanche method. By paying the outstanding debt with the highest interest rate first, you're saving money. That's the kind of thing personal finance gurus focus on; managing debt while saving more money. But our experience is that using the snowball method is better for our clients.

Using the debt snowball method to pay off debt is the right move for people who have trouble with their credit card bills and might not be able to continue paying their minimum monthly payments. For them, paying down debt by focusing on the smallest debt first is the more effective method.

It might not be the best option for dealing with a student loan or a car loan, but tackling the larger debts first just because they're a higher interest debt doesn't always make sense. To someone who works professionally in financial planning, it makes more sense to focus on the total interest paid, and save the lower interest rate debts for last. But those are not the kind of people who come to us for counseling.

Most credit cards require only 2%–3% of your balance as a monthly minimum payment. If you only pay the minimum, it could take decades to eliminate your debt, especially if you keep charging new purchases.

For example, a $5,000 balance at 25% APR with a $100 monthly payment would take more than 11 years to pay off, and cost nearly $4,000 in interest payments.

That’s why making extra payments is key. Both the debt snowball method and avalanche methods push you to do more than the minimum and stay focused on progress.

At first glance, a personal loan for debt consolidation may seem like a solution. You combine your debts into one loan, ideally with a lower interest rate and one simple monthly payment.

But at Credit.org, we don’t recommend this approach. To us, this kind of loan is not a debt reduction method at all.

Here’s why:

If you haven’t changed your spending habits, consolidating with a new loan makes your situation harder to manage. And if you use your home equity or an auto loan to consolidate debt, you're putting assets at risk when you should be protecting them.

If you’re overwhelmed and need help to pay off debt, a Debt Management Plan (DMP) is a better fit than a new personal loan.

With a DMP:

DMPs are not loans and don’t require a high credit score. Learn more about how they work at Credit.org’s Debt Management Programs.

While the snowball and avalanche are the most popular, other methods may apply depending on your goals, habits, or financial pressures.

These cards offer promotional interest rates for a limited time, often 0% for 12 to 18 months. If you qualify and can pay the balance within that window, you may save a lot in interest. But when you fail to pay off the balance or keep spending, the debt will grow worse.

Some people take out a personal loan to consolidate their debts. While this can sometimes reduce your interest rate, it usually extends your repayment term. And you're able to continue using your credit cards, so you end up with double the debt.

A nonprofit DMP gives you a structured path to repayment without taking on new debt. You make one monthly payment, and the agency works with your creditors to lower rates and stop fees. This is often the best option for people who are falling behind but don’t want to pursue bankruptcy.

This approach involves negotiating with creditors to accept less than the full balance. It can hurt your credit, and forgiven debt may be taxed as income. It should only be considered after other options have been explored.

In some cases, bankruptcy is the only path forward. If you’re behind on every bill, can’t make your minimum monthly payments, and have no way to recover in the near future, this may be the relief you need.

Chapter 7 or Chapter 13 bankruptcy can discharge certain debts or restructure your payments. However, it has serious long-term consequences for your credit and should be discussed with a counselor or legal expert before filing.

No matter which strategy you choose, consistency matters. Here are habits that can help you stay in control:

Staying committed is more important than choosing the “perfect” strategy. Whichever path keeps you motivated and moving forward is the right one for you.

Many people find that their debt situation includes more than just credit cards. If you’re managing a student loan, car loan, auto loans, or other larger debts, it’s important to include those in your overall strategy. These often come with a fixed repayment term, and while they may have a lower interest rate, they still affect your monthly budget.

A good financial advisor or credit counselor can help you determine whether to prioritize these higher interest debts or continue paying them on schedule. Just make sure your plan ensures all your debt is paid, including larger debts that might not be as easy to eliminate with the debt snowball or debt avalanche method alone.

Watch for these milestones as you work through your plan:

When your financial situation starts to feel more stable and predictable, you’ll know you’re on the right path. For free, trustworthy information on getting out of debt, including debt consolidation, settlement, and bankruptcy options, check out the FTC’s guide on how to get out of debt.

You don’t have to face debt alone. At Credit.org, we’ve helped thousands of individuals and families pay off debt, choose the right strategy, and build a realistic debt repayment plan.

We offer:

If you’re ready to start making progress, schedule a counseling session or explore our debt relief services today.