Buying your first home is a huge step—and it comes with more costs than just the home’s listing price. It’s easy to focus only on the monthly mortgage, but being ready for all the related expenses will make you a better-prepared buyer. Here are eight important expenses to expect when buying your first home.

The down payment is the upfront amount you pay toward the purchase price of the home. Most first-time buyers put down anywhere from 3% to 20%. For example, on a $300,000 home, a 5% down payment would be $15,000.

A bigger down payment can lower your monthly mortgage payment and may help you avoid having to pay private mortgage insurance. If you can’t afford a large down payment, consider FHA loans, which allow you to put down as little as 3.5%.

Closing costs include all the fees required to finalize your home purchase. These can add up to 2% to 5% of the home price. That means for a $300,000 home, you could owe an additional $6,000 to $15,000 at closing.

Common closing costs include:

You might be able to negotiate for the seller to cover part of your closing costs, but it’s smart to budget for the full amount yourself.

Homeowners insurance protects your investment from damage caused by fire, theft, storms, and other events. Lenders require proof of insurance before approving your mortgage loan. Your annual premium depends on the home’s value, location, and condition.

On average, insurance premiums range from $800 to $2,000 per year. Shop around for quotes and be aware that some areas may also require additional insurance policies, like flood or earthquake insurance.

Property taxes are charged by your local government based on your home’s assessed value. These taxes can vary widely by location and are often included in your monthly mortgage payment through an escrow account.

For budgeting purposes, assume 1% to 2% of your home’s value annually. On a $300,000 home, expect $3,000 to $6,000 per year, or $250 to $500 per month. A mortgage calculator can help you estimate these monthly costs.

If you put down less than 20% on a conventional loan, your lender will likely require private mortgage insurance (PMI). This adds an extra monthly fee to your loan to protect the lender in case you default.

PMI can cost between 0.5% and 2% of the loan amount annually. That could mean an extra $100 to $300 per month on a $250,000 loan. Once you build enough equity in your home—typically 20%—you can request that PMI be removed.

Learn more about private mortgage insurance from the CFPB.

As a homeowner, you’re now responsible for fixing everything that breaks. That includes plumbing, electrical systems, roofing, appliances, and landscaping.

Experts recommend budgeting at least 1% of your home’s purchase price each year for maintenance. On a $300,000 home, that’s about $3,000 per year—or $250 per month.

Big repairs like replacing an HVAC system or roof can cost thousands. Having an emergency fund or making extra payments toward savings each month can help you cover these surprise costs.

Utilities like water, electricity, gas, and trash collection aren’t included in your mortgage, and you may find them higher than what you paid while renting. You’ll also be responsible for:

Make sure to get utility estimates based on the ZIP code and size of the home so you can add these to your monthly cost planning.

Many first-time buyers forget to factor in the cost of moving and furnishing a new home. Expenses may include:

These items may not seem like much individually, but they add up fast. Planning for at least a few thousand dollars will help you move in without financial stress.

The total mortgage payment is only part of the cost of homeownership. Budgeting for these eight expenses ahead of time can prevent you from being caught off guard. Every dollar you save now will help when unexpected costs come up later.

In the next section, we’ll show you how to use a mortgage calculator to estimate your homeownership costs more accurately. A calculator can show you not just your base payment, but also help you estimate loan details like monthly mortgage payments, PMI, and property taxes, giving you a realistic view of how much home you can truly afford.

After understanding the eight major expenses you’ll face as a first-time buyer, the next step is figuring out how to budget for them. One of the best tools available is a mortgage calculator. It’s free, easy to use, and helps you estimate your total monthly payment and compare different loan types.

A mortgage calculator is an online tool that helps you estimate your monthly mortgage payments based on inputs like:

A good calculator gives you a breakdown of principal and interest, plus any other monthly obligations that may be bundled into your mortgage payment. It’s a fast way to understand your financial limits and avoid overborrowing.

This is the amount you expect to pay for the home. If you’re still browsing listings, use the average price in your target neighborhood.

The down payment amount is subtracted from the home price to calculate your loan amount. The larger your down payment, the lower your monthly cost and interest charges.

This is the number of years you’ll take to repay the loan. Common options are 15, 20, or 30 years. A shorter loan term usually means a higher monthly payment, but you’ll save money in interest over the life of the loan.

Your interest rate is based on your credit score, market conditions, and loan type. You can enter current mortgage rates from lenders or use national averages as a starting point.

These vary by state and ZIP code, but many mortgage calculators allow you to add this estimate. A safe assumption is 1.25% of the purchase price per year.

Typical premiums range from $800 to $2,000 annually. If your home is in a risk-prone area, you may need additional coverage, which you can include in your estimate.

If you’re putting less than 20% down on a conventional loan, expect to pay PMI. This can be entered as a percentage of your loan amount, usually 0.5% to 2%.

If your home is part of a community association, you’ll pay monthly or quarterly dues. Include these as part of your monthly cost.

Let’s say you’re buying a $350,000 home in a suburban ZIP code.

You plan to:

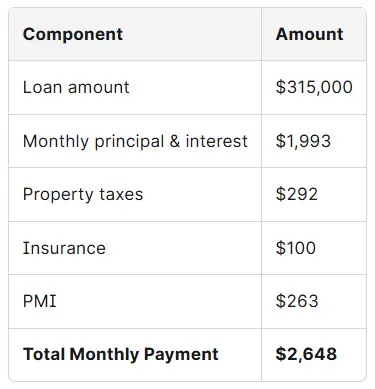

A mortgage calculator would show:

That total represents your full obligation every month—not just the base loan. Understanding this is essential when deciding how much house you can afford.

A good mortgage calculator lets you switch between different loan types, like:

For example, if you qualify for an FHA loan with a smaller down payment but higher insurance premiums, a calculator can show whether that trade-off makes sense long term.

You can also experiment with:

Many calculators include charts that show how much interest savings you’d gain by accelerating your repayment plan.

Not all calculators are created equal. Make sure the one you use includes fields for:

Tools like the mortgage payment calculator from trusted housing nonprofits or your bank’s website often offer more accurate and complete features.

Find our Maximum Mortgage Calculator here. We also offer a Mortgage Payoff Calculator.

Buying a home isn’t just about the home price. It’s about understanding your full financial picture—from down payment to loan amount, from PMI to property taxes, and from monthly payment to the total cost over the loan’s lifetime.

A mortgage calculator helps you make smart, informed decisions. Combined with a solid understanding of the 8 major expenses, it’s your best tool for navigating the home buying journey with confidence.

Let credit.org help you move toward homeownership! Our homebuying coaches can offer expert advice and answer your questions about the process.