June is National Homeownership Month; it began in the 1920's as a “Real Estate Week”, and expanded in 2002 to a national, month-long event. This is a time to celebrate and promote homeownership, and to educate and encourage Americans to take advantage of the many benefits that homeownership brings.

Homeownership Month is a great time to start working toward your first home. There are many resources available online to help you get started the right way. If you're not yet a homeowner, or are thinking of returning to homeownership after some time away, here are 10 steps to take toward your first home during Homeownership Month:

Start by pulling all three of your credit reports. Fix any errors fast—an improved score can mean lower interest rates and a smaller monthly mortgage payment. Most lenders want to see timely payments for at least 12 months. Keep credit card balances under 30 percent to boost your score and your odds of preapproval.

Aim for a minimum down payment of 3 percent on conventional loans or 0 percent on VA loans for qualifying service members. Use gift money from a family member if the lender allows it, but document every dollar. The bigger your down payment amount, the less you’ll pay in mortgage insurance and the lower your total loan amount will be.

Tip: Check state and local down-payment assistance programs—many update funding each spring. Fannie Mae is a good starting resource for down payment and closing cost assistance: FannieMae.com

Use an online application to get pre-approved and receive a written loan estimate. This three-page form shows the total loan, projected monthly payment, and closing fees so you know how much house you can afford before you shop. Getting quotes from at least three lenders can save thousands over the life of the home loan.

According to the Freddie Mac Primary Mortgage Market Survey, the average 30-year fixed rate sits at 6.89 percent (May 29, 2025). Shopping lenders could shave 0.25 percent or more off that rate. freddiemac.com

Hire a licensed real estate agent who knows your local market. Your agent will write your purchase offer, negotiate repairs, and steer you through paperwork. Remember, the seller’s agent represents the seller—your own agent protects your best interest.

-min.webp)

Schedule a professional home inspection to uncover necessary repairs like roof leaks or faulty wiring. Next comes the home appraisal, which tells the lender the property’s appraised value. If the appraisal is lower than the purchase price, you can renegotiate or walk away.

Once the inspection clears, shop for homeowners insurance. Most lenders require 12 months of coverage paid upfront and may collect future premiums in an escrow account along with property taxes. Ask insurers to re-quote each year to keep costs down.

Closing costs usually run 2–6 percent of the overall loan amount. Typical fees include the appraisal, title search, lender charges, and prepaid taxes. The Consumer Financial Protection Bureau’s closing checklist explains each fee in plain language and reminds buyers to review the figures line-by-line on the Closing Disclosure before signing. consumerfinance.gov

Do a final walk through (often the evening before closing) to confirm the home is move-in ready, requested repairs are complete, and appliances remain. Bring your must-have list and flag anything that changed since the inspection.

On closing day, you’ll sign the mortgage note, deed of trust, and tax forms. Compare each number on your Closing Disclosure to the earlier loan estimate. Small variances are normal, but big surprises demand answers before you sign. Bring a government ID, proof of homeowners insurance, and certified funds or a wire for any cash due at loan closing.

Congratulations, the home buying process is done and you’re now a homeowner! Change the locks, set reminders for monthly payments, and build an emergency fund for upkeep. Review your budget every six months, because owning a house often costs more money than renting.

(Learn more: 10 Common Myths of Homebuying Debunked)

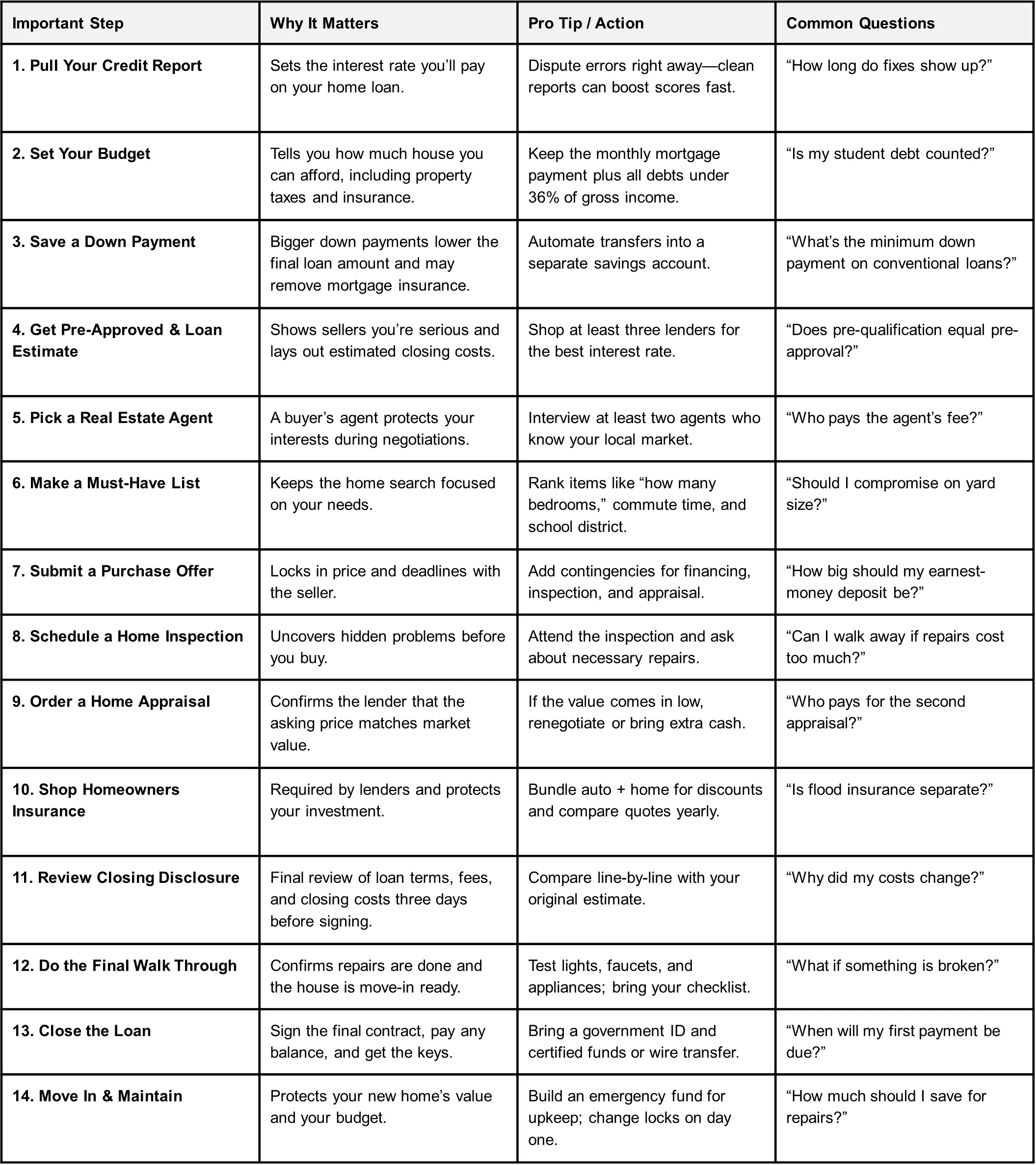

Use this sheet as a quick reference to stay on track during every stage of the home buying process—from checking your credit to turning the key after closing.

These up-to-date tools ensure you’re leaning on reliable information as you tackle each stage of the home buying process. Happy house hunting!

If you want to learn more about budgeting or how to reach your financial goals, get started with our free, confidential counseling and education right here at Credit.org.