Income-driven repayment (IDR) plans can make student loan repayment more manageable, especially if your income is low or unpredictable. These plans adjust your monthly payments based on your income and family size, helping you stay on track without stretching your budget too thin.

Let’s explore the different types of IDR plans, how they work, who qualifies, and how to choose the best option for your situation.

An income-driven repayment plan ties your monthly loan payment to how much money you make. Instead of paying a fixed amount based on your loan size, your payment is calculated based on your discretionary income, which considers your adjusted gross income and family size.

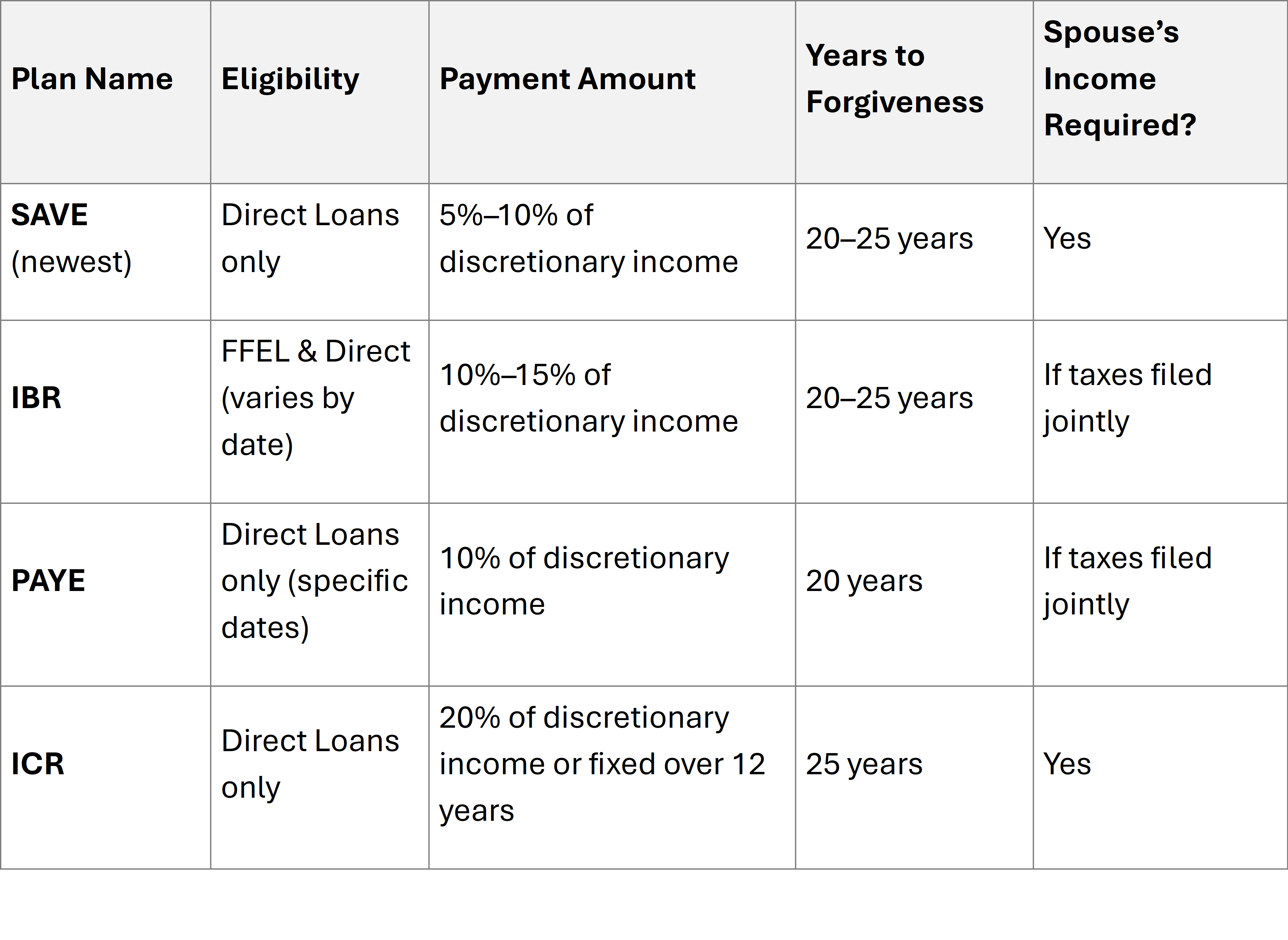

There are four main types of IDR plans:

Each plan has different eligibility rules and formulas, but they all share one goal: to keep payments affordable while avoiding default. The CFPB has more info on these options.

Note: Parent PLUS loans are not eligible for most IDR plans unless consolidated. For full details and eligibility tools, visit StudentAid.gov. Find a more comprehensive comparison chart at ReadySetPay.org.

Most income-driven repayment options are only available for eligible loans under the federal Direct Loan Program. These include:

Private student loans, Parent PLUS Loans (unless consolidated), and older loans like FFEL that haven’t been consolidated typically do not qualify. If you have defaulted loans, you must resolve the default before qualifying for an income-driven repayment plan. Options include loan rehabilitation or consolidation.

To check your eligibility, visit StudentAid.gov and review your loan types under your loan servicer’s records.

The government uses a formula that includes your income and family size to determine your payment amount. The larger your household and the lower your taxable income, the lower your required monthly payment will be.

Some borrowers qualify for $0 payments, especially if they fall below the federal poverty line or are temporarily unemployed.

Your discretionary income is the difference between your income and 100–225% of the poverty guideline for your family size and state. IDR plans use this figure to set your minimum monthly payment.

The income-based repayment plan (IBR) caps payments at 10–15% of your discretionary income, depending on when you borrowed. IBR is a popular choice because it works with a variety of loan types and may offer loan forgiveness after 20–25 years of payments.

Other IDR options may offer lower monthly payments or a shorter timeline to forgiveness, depending on your loan history.

The Saving on a Valuable Education (SAVE) Plan replaces REPAYE and is the most affordable option for many borrowers. The SAVE plan calculates payments using a higher income exemption, reducing the share of income used to determine payments. Some borrowers may pay as little as $0 per month.

SAVE borrowers benefit from a more generous income exemption and reduced monthly payments compared to earlier IDR plans. According to Brookings, the SAVE Plan is one of the most generous programs in the history of federal loan repayment. SAVE Plan borrowers working in lower-income professions may see the most immediate relief, especially if they qualify for forgiveness after making consistent payments.

If you work full-time for a government agency or nonprofit, public service loan forgiveness (PSLF) could forgive your remaining balance after just 10 years of qualifying payments on an IDR plan.

To qualify:

Read more in our full guide to Public Service Loan Forgiveness.

The income based repayment plan works well for borrowers who borrowed before 2014 or do not qualify for newer IDR options. However, the SAVE plan offers better terms for most borrowers today.

SAVE plan forbearance is also more generous; borrowers experiencing hardship may qualify for $0 payments without entering default.

If you have ineligible loans, loan consolidation can help you qualify for IDR. For example, FFEL and Perkins loans must be consolidated into a direct loan program before being eligible.

Use the online loan consolidation application to begin the process.

To enroll or recertify, you must submit your income using the federal tax information directly via your loan servicer or through StudentAid.gov.

Make sure to provide consent to access your tax information, which is used to calculate your payment amount.

You can use the IDR application to apply or switch to a different plan. The form walks you through each option and lets you compare monthly payments side-by-side. It’s easy to use for existing borrowers or those recently in grace periods.

Income-driven plans are designed to ensure that student loan borrowers don’t face payments they can’t afford based on their income and family size. Your monthly payments are based on your discretionary income, which depends on:

Some borrowers may owe as little as $0 per month.

Minimum monthly payment rules still apply, but they’re often low. For SAVE, unpaid interest no longer causes loan balances to grow if you make your full payment.

Over time, even if your accrued interest grows, your principal balance may shrink. Many plans limit interest accrual after 20–25 years of payments.

If you’re tracking your progress, watch your:

When making monthly payments, consistency is key. Use auto-debit when possible. Late or missed payments could reset your qualifying payments count.

If you are one of the many borrowers enrolled in IDR, be sure your loan servicer has your updated income and tax info. This prevents issues with your repayment plan and ensures you’re credited correctly.

Switching to a different repayment plan is allowed, but it may affect your loan term. For example, moving from SAVE to a standard repayment plan increases your fixed payment but reduces the number of months remaining.

Some borrowers may benefit from alternative IDR repayment plan structures if they don’t qualify for SAVE or IBR. Before switching plans, make sure you understand the long-term implications. Our Top 10 Student Loan Mistakes to Avoid article highlights common pitfalls borrowers face when adjusting their repayment strategy.

All borrowers must provide documentation and borrowers provide consent annually for income review. Without this step, you risk losing eligibility or being switched to a plan with higher payments.

This is especially important for low income borrowers or those near the federal poverty line.

If you’ve missed payments recently, the SAVE plan forbearance offers temporary relief. But interest may resume afterward. Know that restarting interest accrual can increase what you owe long term.

Check with your loan servicer before choosing forbearance. It may affect forgiveness timelines and push back your qualifying payments.

The RAP plan (Repayment Assistance Plan) is typically for Canadian student loans, but the phrase occasionally shows up in U.S. discussions around hardship repayment. Don’t confuse it with federal IDR options. For American borrowers, stick to verified federal plans found on StudentAid.gov.

With options like IBR, PAYE, REPAYE, and SAVE, the best plan depends on:

There’s no single “best” plan for everyone. Consider how your taxable income, income and family size, and loan types affect your options.

To compare plans, use the Department of Education’s loan simulator.

Every year, borrowers enrolled in IDR must submit updated income and tax forms. If you’re an existing borrower, missing this can cause your payments to increase or push you off your plan entirely.

Keep your federal tax information and income information ready for your recertification window. This ensures your payments remain tied to your income and avoids surprises. Failing to stay current with your IDR plan can result in involuntary collection efforts, including wage garnishment or the seizure of tax refunds by the federal government.

For a deeper understanding, review TICAS' PDF on IDR Plans.

Income-driven repayment plans are designed to keep student loan debt manageable. But choosing the right plan takes effort. The wrong fit could lead to loan balances growing, long-term unpaid interest, and delays in reaching forgiveness.

Look at your principal balance, loan type, income level, and whether you’re eligible for forgiveness like Public Service Loan Forgiveness. Pay attention to whether you’ve submitted your loan consolidation applications properly and how changes in monthly bills affect your budget.

If you need help comparing plans or managing your federal student loan payments, get professional guidance.

At Credit.org, our certified counselors are here to help you navigate your repayment options. Whether you’re an existing borrower, considering consolidation, or just trying to understand your available repayment plans, we’ll help you choose the plan that makes the most sense for your situation.

Sign up for free Student Loan Counseling today and take control of your repayment journey.